In October 2009, American Horse Publications launched a survey of American horse owners and caretakers to gauge trends in the equine industry. The survey was publicized through local and national equine publications and websites as well as social networking sites like Twitter and Facebook. With over 11,000 usable responses gathered, this was the largest survey of U.S. horse industry participants ever conducted.

In October 2009, American Horse Publications launched a survey of American horse owners and caretakers to gauge trends in the equine industry. The survey was publicized through local and national equine publications and websites as well as social networking sites like Twitter and Facebook. With over 11,000 usable responses gathered, this was the largest survey of U.S. horse industry participants ever conducted.

Demographics: Who are we?

The AHP survey was open to adults age 18 and over. The most well-represented age group was 45-54, which accounted for 30.8% of the respondents. As expected, the vast majority of respondents were female at 88.8%. Nearly 50% of respondents report an annual household income of less than $75,000. Only 13.4% report household incomes of more than $150,000.

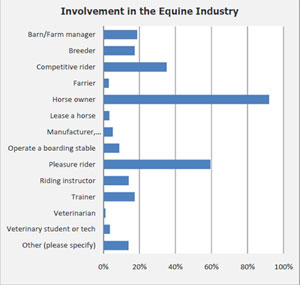

Industry Involvement

92% of respondents are horse owners while 3.3% report leasing a horse. The average number of horses owned is five with the maximum number reported being 300. More than 10% work in the horse industry as farm managers, trainers, breeders or instructors. Nearly 60% ride for fun while just over 35% classify themselves as competitive riders. Respondents were asked to select all classifications that apply, resulting in some overlap.

From Past to Present to Future

The survey asked participants to share their past, present and expected future levels of horse ownership, management and industry participation. Compared with 2007, 25% of respondents own more horses now, 22% own fewer and more than half own the same number of horses as they did two years ago.

Speculating on the future, 16% of respondents believe they will own fewer horses in 2011 than they do now while 19% expect to own more horses in the future. The remaining 65% predict that their herd will stay the same size.

Gift Horses

In light of the poor economy of the past few years and the so-called unwanted horse problem, the survey asked respondents if they had been given any of the horses they currently own, lease or manage. Nearly 32% have been given a horse, and of those, only 3% are formally involved in equine rescue. The question did not ask when a horse had been given, making it impossible to link any trend to the economy or other current events.

Pay to Play

Survey participants are largely responsible for their horses’ daily care, with 80% reporting that they feed, water and clean their own horse. Still, 39% board on someone else’s property, 44% take riding lessons and 33% pay for someone else to train their horse.

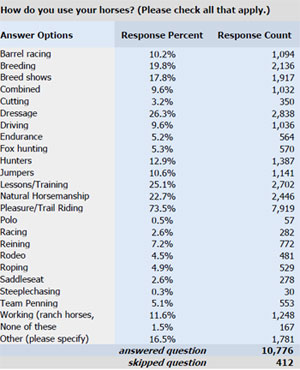

What We Do

Survey participants were asked to identify all the ways in which they use their horses. Nearly three-quarters or respondents report using their horses for pleasure or trail riding at least some of the time. One of the surprising results of the survey was that the second most common reported usage for horses is dressage at just over 26%. Lessons and training, natural horsemanship and breeding round out the top five most common uses.

The survey calculated trends by geographic region, age, and income level. For horse use, those with the highest income were less likely to use their horses for trail riding or natural horsemanship. However, dressage was more common in the higher income levels. The highest geographic concentration of trail riders is in the west and southwest, and use of horses for breeding increases from east to west. Dressage is most popular in the east while natural horsemanship is most popular near the west coast.

Survey respondents participated in an average of five competitions in 2009. Those in the highest income brackets competed more than others with competitive participation dropping off considerably for those with household incomes under $75,000. Younger participants are significantly more likely to compete than those in older age groups.

The Cost of Horsekeeping

It’s no secret that horse ownership becomes more expensive over time. Nearly three-quarters of respondents report spending more money per horse now than they did two years ago with hay and feed being most widely identified as having increased in cost.

Most respondents (68.5%) anticipate a continued increase in horsekeeping costs over the next two years. When asked how they will accommodate this increase, more than 70% of respondents say they will reduce spending in other parts of their lives to be able to continue to afford their horses. Nearly a third of respondents say they will increase their income while 24% are willing to reduce the number of horses they own.

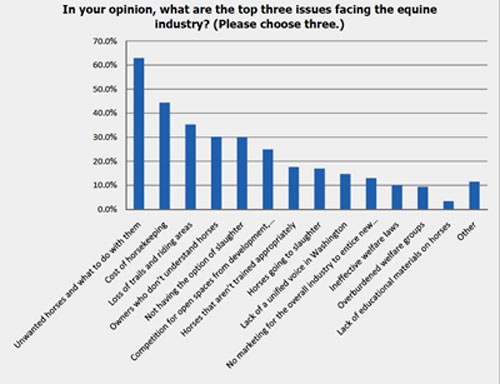

Hot-Button Issues

Given all the recent press given to the plight of homeless horses, it is not surprising that more than 60% of respondents selected “Unwanted horses and what to do with them” as one of the three most important issues facing the equine industry. The cost of horsekeeping came in second at 44.4% and loss of equestrian land was third at 35.3%.

When asked what issues should be addressed first, nearly a third of respondents selected the unwanted horse issue. The second most common response was, “Not having the option of slaughter” with 17%. The youngest group of respondents, those ages 18-24, are most likely to view both horses going to slaughter and horse owners not having the option of slaughter as a primary concern. The lack of equine slaughter is less likely to be a concern for respondents with a household income of more than $125,000. Loss of equestrian lands is a bigger concern in the west than in the east.

Respondents were given the option to propose a solution to the issue they view as most pressing. Nearly three-quarters of respondents did offer a solution, and the first 3,752 responses were analyzed. 22.1% of those offering solutions believe that slaughtering horses should be an option. Just over 10% propose breeding regulations or restrictions. Improved education for breeders and horse caretakers was proposed by 9.7% of respondents who offered suggestions.

Equine Health Care

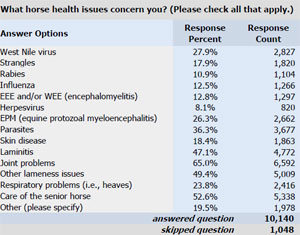

Horse owners tend to be hands-on in their horses’ health care. Of respondents who board their horses, nearly 68% make the health care decisions for their horses, and nearly 30% use a combination of their barn manager, their vet, and themselves. Less than 2% leave the decisions entirely up to their barn manager or vet.

The vast majority (96%) of respondents vaccinate their horses. 78% involve their veterinarians in the vaccination process. 80% purchase their vaccines from the vet.

Nearly all respondents deworm their horses with 99% reporting that they do. Only 16%, however, involve their vets in the process. Horse owners are most likely to get their dewormers at their local tack or feed store (43.6%), online (25.8%) or from catalogs (14.8).

The equine health issue most commonly selected as a top concern is joint problems at 65%, with another 52.6% indicating senior horse care. Other lameness issues and laminitis were also high on the list, with approximately 50% indicating those as concerns.

Info, Please

How do horse owners keep up-to-date with equine health information? Most respondents (91%) consult their vet. Roughly three-quarters of participants also consult magazines and websites. Nearly two-thirds talk to their friends or other horse owners, and half get some horse care guidance from their farriers. The oldest group of respondents, those aged 65 and older, are least likely to talk to their friends for horse care info. Those in the youngest group, 18-24, are least likely to talk to their vet. Interestingly, the middle age group from 25-55 are significantly more likely to seek out horse care information online.

Read the full survey results at www.americanhorsepubs.org

I was one of the respondents to this study and I just wanted to say that it was very interesting to both participate and to see the results.

I find this data very interesting. I guess I am a statistics nut at heart- especially when it relates to horses.

It’s fun to see the results of this study after having participated. It’s interesting to see where I rank in comparison to the average.

There seemed to be a high level of interest in horse slaughter. I wonder if that was because the topic of putting a horse down humanely wasn’t a choice.

I found the answers pretty much on.

http://www.horselogs.com is a great way to keep track of you horse records.

Agreed, horse management software makes our lives so much easier.

Some people are just plain sick. Horse slaughter is morally wrong, and just plain wrong. They are not a livestock animal in the U.S., they are companions, just as dogs and cats. Next, the U.S. will be just as bad as Asia and will be killing our dogs and cats. Dogs and cat, livestock animals? I Don’t Think So! So seriously people, you aren’t a horse lover if you support the killing of companion animals. Not only do some of the people in this survey support slaughter, they support “Option of Slaughter”, meaning that some would send their own horses to slaughter. That is just plain sick. I mean really, you people call yourselves horse lovers? If you support the option of killing your own animals, who are you? This is just appalling, scary, and wrong on so many levels.

This article confirms many of the trends that I have been seeing in the horse industry. In response to the slaughter issue…no, I do not want to send my long term companion to the meat plant. But, when you have uninformed horse owners that are over breeding their herd, ever increasing the amount of un-wanted horses in the U.S., then we all have to re-consider the slaughter option. There are now today more horses in the U.S. than there were 60 yrs ago, when we were using them on the family farm.